Business Insurance in and around Winchester

Looking for insurance for your business? Look no further than State Farm agent Kim Smith!

Cover all the bases for your small business

Coverage With State Farm Can Help Your Small Business.

Running a small business requires much from you. Getting the right insurance should be the least of your worries. State Farm insures small businesses that fall under the umbrella of contractors, retailers, specialized professions and more!

Looking for insurance for your business? Look no further than State Farm agent Kim Smith!

Cover all the bases for your small business

Get Down To Business With State Farm

You are dedicated to your small business like State Farm is dedicated to reliable insurance. That's why it only makes sense to check out their coverage offerings for surety and fidelity bonds, commercial liability umbrella policies or business owners policies.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Kim Smith is here to help you discuss your options. Get in touch today!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

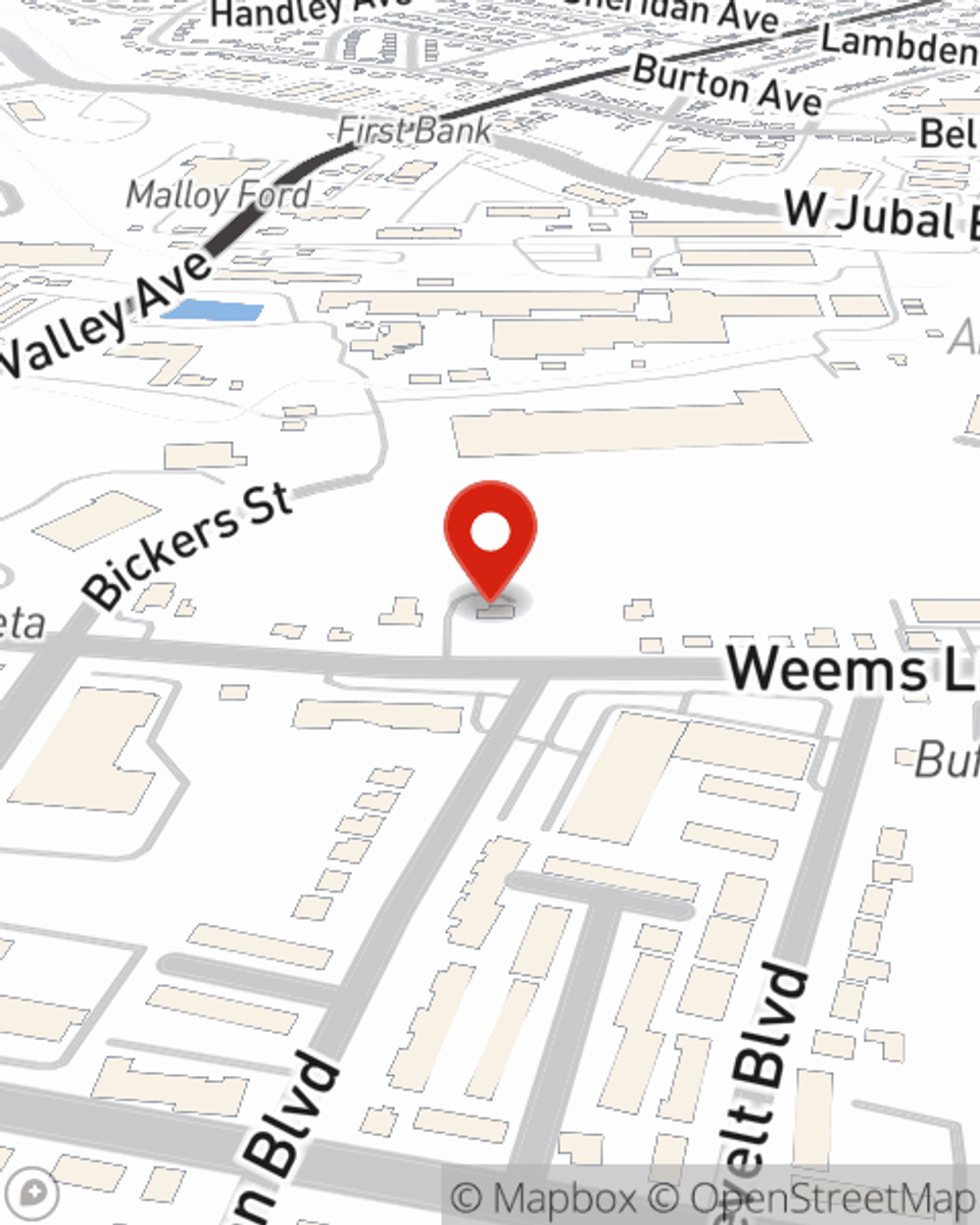

Kim Smith

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.